Truth in Money Changes Everything

Keys to happier, successful personal finance in 2025. Answers hide in obscurity and confusion, and can thrive in the light of day.

This article goes out to anyone looking to get (more) intentional with their money in 2025. It ain’t one of my most creative, but it will be one of my shorter and most practical articles. It’s for those, of all income levels, who yo-yo with credit card debt, experience a lot of private financial stress, and can’t quite seem to get ahead in any lasting way.

If you’re in the camp of most of my clients who feel like they’ve tried everything, I have a question for you: Have you tried truth? Jesus says in the New Testament: “The truth will set you free.” He was talking about eternal truth and freedom, but, boy oh boy, does this phrase ever apply to every part of life, including our money lives.

Truth: “That which is in accordance with fact or reality”

It’s easy to think more money is the answer, especially when the only other option seems to be spending less. But for most people, looking—really looking—at current spending habits and your real cost of living, is the missing key before either of these solutions can help. Trimming expenses, transferring credit card balances, and adding income without taking honest stock of your situation accomplishes much less than you hoped. Answers hide in obscurity and confusion, and thrive in the light of day.

Answers hide in obscurity and confusion, and thrive in the light of day.

As soon as you can see things for what they really are, it’s amazing how evident and exciting your solutions become. How the same actions you’ve already tried finally work. It never gets old seeing clients quickly gain hope, direction, and motivation when they see the organized truth of their current circumstance.

From nearly a decade of writing about and coaching others to be more intentional with money—so they can be more intentional with life and work—here are my best recommendations for truing up your money this year.

If your system isn’t helping you, you might just need to see your situation organized differently.

If you are overspending (accruing debt), quantify it. A problem you can quantify is a problem you can start solving.

Before trying to pay off debt, see how you can stop accruing debt.

Before you choose to trim your spending much beyond what’s necessary to stop accruing debt, focus on building budgeting habits. This helps you see budgeting as your friend, not foe.

Share your numbers with someone you trust to be compassionate and helpful. Things stuck in your head have a way of running on the same, unhelpful loop.

Conduct hypothetical, realistic scenario planning. In this case, “realistic” is a really good thing since it means these options can actually happen.

Create a budget to keep your money organized. My favorite approach is zero-based budgeting, and You Need A Budget is my favorite tool. A good budgeting tool is like the shelves you use to keep your home organized—it’s how your hypothetical plan translates into reality, and stays organized.

Did one recommendation stand out most to you? I’d love to know.

For those wanting more: There’s a lot more tactical advice I could share, and—what do you know?—did in my book Dear Fellow Spender and articles like the below. If you’re looking for more help and accountability, contact me to see if I have availability for 1:1 coaching.

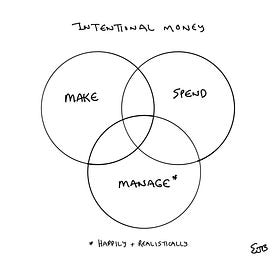

The Third Option in Money and Life

When it comes to solving financial stress, it’s natural to think you have only two options—make more or spend less. While it’s possible one or both will figure into your eventual solution, there’s a third, more doable, and I think exciting option available.